Ethiopia's banking industry is not new to foreign banks. Banco di Roma and Abyssinia Bank are worth mentioning.

However, for more than half a century, the Ethiopian market has kept economic sectors such as banking and telecom closed to foreign investors and private investors.

Former Prime Minister Meles Zenawi appeared at the World Economic Forum in 2012 and made a strong statement saying that Ethiopia "does not have the capacity to open up the Bank and Telecom".

The Prime Minister at the time said, "No, we should control them; They use tools that we cannot understand. How can we control them? It is not possible. They said that we don't have the capacity now.

As much as there are those who support this position of the Prime Minister, there are those who argue that we cannot remain isolated from the world market.

When Prime Minister Abiy Ahmed came to power, he hinted that the houses of government-owned institutions could be put up for sale.

It is said that the government decided to do this in order to attract more foreign direct investment and modernize the country's economy based on agriculture.

In addition, this step is believed to be important for economic growth by facilitating the supply of foreign currency, job creation and international competitiveness.

Following the fact that the telecom sector is open to foreign investors, it has been decided to open the banking industry to foreign banks.

Last February, Prime Minister Abiy Ahmed said in his speech to the House of People's Representatives that "banks should be equipped with modern methods and technology to keep pace with global growth and compete with other countries' banks."

The National Bank has been revising the banking policy, rules and regulations to implement this decision.

The amendment includes setting a minimum capital to allow foreign banks to start operations through joint ventures.

Will the coming of foreign banks to Ethiopia be a threat to local banks? What do they bring to the consumer?

What do they bring?

Many African banks are showing interest in entering the Ethiopian market.

In recent years, various foreign banks have opened offices in Ethiopia and are considering the country's market.

According to the information published by a website called 'Farther Africa' in 2020, since 2015, nine foreign banks have opened agent offices in Ethiopia.

Zemedeneh Ngatu, Global Chairman of the Fairfax Africa Fund, says: "The declaration is a big step forward."

The financier who cites the experience of other countries that opened up the sector; Ethiopia, which ranks third in terms of gross national product (GDP) in sub-Saharan Africa after Nigeria and South Africa, says that the opening of the sector "shows that it is ready for business".

“When foreign banks come, they bring their international experience. They bring their management experience, technology, and foreign exchange. They have the capacity to accommodate foreign investors."

Zemedeneh banks also consider the services they provide to their customers as an advantage.

“In American banks, for example, they take great care of their customers. In our country, the user begs the bank to use it. It is the reverse. And they lend to a certain person."

Consulting and auditing expert Tilahun Girma, a member of the United Kingdom's Chartered Accountants Association, says that one of the benefits of foreign banks coming to the country is attracting foreign investors.

"Opening the door to foreign banks will allow new technologies to spread; It will pave the way for new banking services to be delivered to customers. It may invite foreign investors who are not confident that local banks will provide adequate financing.”

The consultant adds, "For example, if Citibank or Standard Chartered enter Ethiopia, foreign investors will see a positive side when doing research."

But according to Ato Tilahun, Ethiopia opened the banking industry to foreign banks because of pressure from international institutions.

"One of the standards of the World Trade Organization is that countries should not block trade and services. Therefore, the pressure mainly comes from international financial institutions and the World Trade Organization.

We are your relatives. They say that when international banks come to Ethiopia, they have the opportunity to work with local banks, so the technology will be transferred.

However, the accounting consultant Tilahun says that although domestic banks are at a better level of capital and technology than before, they still have a long way to go.

So how can Ethiopian private banks face this competition?

What hope do indigenous banks have?

Zemedeneh Ngatu, who says that the entry of foreign banks is a "good opportunity" for local banks, said, "Although local banks are profitable, they do not have the experience to compete at the international level." They argue that when these foreign banks come, they will have the opportunity to work with them.

The government suggests that indigenous banks should merge if they want to remain competitive under the new policy.

Your relatives agree with this.

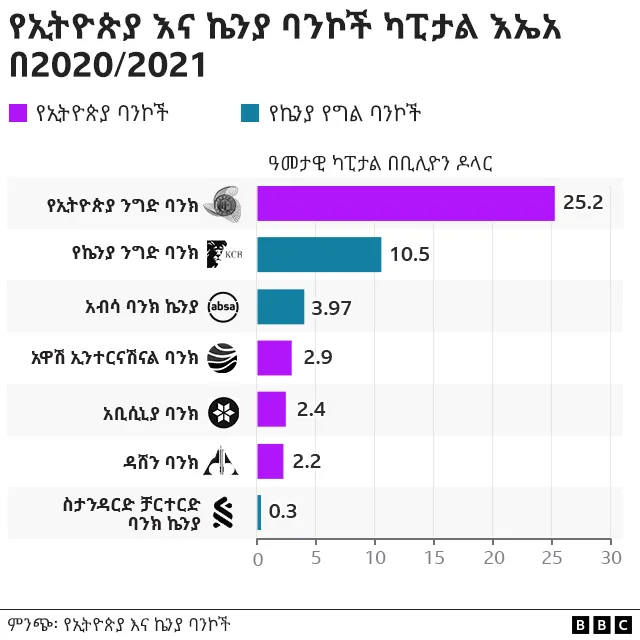

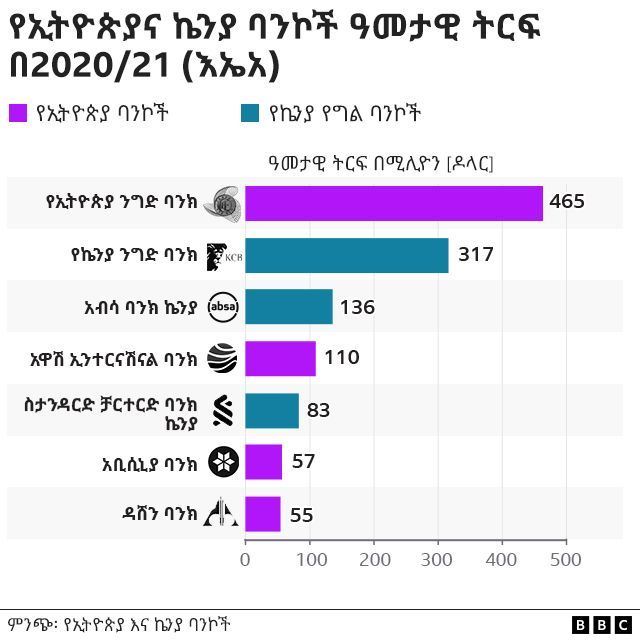

A relative who worked with Ernst & Young for several years; "Awash Bank, which is the largest private bank in Ethiopia, is ranked 83rd even in Africa," he said, stressing that banks should be united.

"The capacity of banks in the sector is of great value. We have 18 banks; Soon three, four may be added. About 10 are awaiting approval. This is not important at all. In my estimation, a year and a half ago, there will be 5 large capacity private banks.”

They say that if banks merge, their lending capacity will increase, their technology will improve, and even if foreign banks come, they will have resistance.

Citing Nigeria as an example, consultant and auditor Tilahun said, “First, they can be voluntarily integrated; Or the capable can wrap the powerless."

Regarding the threat that local banks may go bankrupt when foreign banks enter, he said, "I do not think that Ethiopian banks will disappear." Do 'Corporate' rip off their customers? yes!" Says Ato Tilahun.

"Let's make no mistake, these foreign banks are not supposed to penetrate into rural areas and do [retail banking] at a low level."

Zemedeneh said that in addition to the merger of banks, it is viable if the economic system called 'Joint Venture' can be implemented.

“For example, China first allowed banks to enter through 'joint ventures'. This means getting foreign banks to buy some shares and get them in."

They think that if they can buy shares from banks in Ethiopia and work together, they will have a good chance to grow.

Tilahun, who argue that indigenous banks will not disappear, says that because foreign banks focus on the capital Addis Ababa and other big cities, indigenous banks can serve the rest of society.

"Unless we force them by policy, they do their work in one headquarters; It is not expected that banks will open branches in every village like us, but by connecting the rest through technology.

The consultant brings up the idea of the 'corporate client' again and again. So what does a corporate client mean?

“There is something called 20/80 in the banking industry. 20 percent are major foreign exchange earners for banks. I have no doubt that foreign banks will come in droves to grab these customers. It is wrong to think that their target is 'corporate' customers and they will go down and give loans.

Shadow. "That's why I say they should be integrated to be able to compete; The National Bank is not required to control thirty forty banks.

The professional. The national bank may increase the 'capital' of the banks from the current level soon, and "to meet this, the only option that the indigenous banks have is to merge."

"This is not the time to bring in foreign banks."

Ayele Galan (Dr.), a researcher at the Kuwait Institute for Scientific Research, who is known for providing various articles on economic issues, is among those who are strongly opposed to allowing foreign banks to enter Ethiopia.

"This decision is like giving medicine for a stomach ache to a person with a headache," the economist said, opening the banking industry to foreign banks "does not take into account the actual situation in the country."

According to Ayele, Ethiopia's banking and finance industry has two serious problems.

One of them is 'structural imbalance', which means that large state-owned banks compete with 'small' ones.

To solve this, they say that these large banks should be divided into small banks or made private [privatization], bringing in foreign banks is not the solution.

According to the economist, the second problem in the financial sector is regulation. They cite the interest rate on bank loans as an example.

"It is absurd to say that he will change the country after borrowing at 15 or 18 percent interest rate from the countries of the world, doing business, making a profit and returning the loan."

They say that this problem has arisen due to the consensus of government bodies and bank owners.

But they argue that the coming of foreign banks to Ethiopia will allow the interest rate to decrease.

“The entry of these foreign banks will activate other private banks. For example, there may be an interest reduction," says Tilahun.

Ayele Gelan (Dr.), who argues that the loan interest rate should be reduced to seven or six percent like other countries, explains that although the banks' profits may decrease, millions of people who could not borrow before will get access to loans.

The expert says that the government allowing foreign banks to enter "doesn't have anything to do with the two main problems raised above".

The researcher strongly criticizes the idea of foreign banks bringing in foreign currency. When explaining this, it is by mentioning the saying of Farang that "it is useless to customize a temporary solution for a permanent problem".

“When a company comes home, it may bring billions of dollars. But after starting work, it exports dollars every month. These banks have no reason to bring the dollars home and donate them when we export products that bring dollars home."

he saw They also reject the argument that foreign banks introduce new technology as "false economics".

“The technology these banks are bringing is not rocket science. Technology is in the minds of people, not in the hands of banks. If they say we will put in a car assembly plant or a fertilizer factory, he will agree."

control

When foreign banks enter the Ethiopian market, what kind of control should they have? The question is another argument.

"Those who say that no bank has failed in Ethiopia in the last 27 years, they believe that Zamedeneh National Bank has done a good job in terms of control so far.

“However, now that foreign banks are coming, the national bank must increase its regulatory capacity.

Because supervising local banks and supervising highly complex international banks are very different things.”

Tilahun also speculates that new regulations for banks that focus on 'corporate' customers may be issued soon.

National Bank; They believe that "a healthy loan amount will settle the bill" when foreigners enter the country.

But they say; "Just as they are allowed to enter now, it should be considered how they will be when they leave."

"We need to follow the instructions issued by the National Bank. I think it should be measured how much money you can withdraw each year. There should be a fair way for Ethiopians to buy their shares."